We will not pay any claims in respect of:

a) Dependent on your choice of maximum claims per year (2 or 4) we will not pay any claims exceeding your chosen limit. For example, if you chose 2 claims per year, we would not pay for the 3rd in that year.

b) Where the damage of Your Alloy Wheels is deemed to be a manufacturing defect.

c) Theft of Alloy Wheels.

d) Cracked or buckled Alloy Wheel(s).

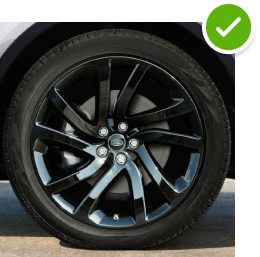

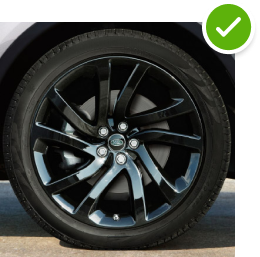

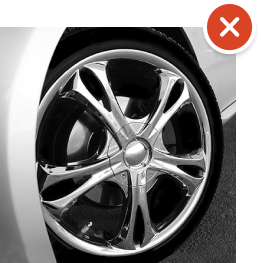

e) Alloy Wheels with split rim construction with chrome effect finishes, or Milled

f) Non- standard or aftermarket Alloy Wheels.

g) Damage caused by driving whilst a tyre is deflated or because of tyre replacement.

h) Damage present on any Alloy Wheels prior to the start of this policy.

i) Any deliberate damage caused by You or any omission on Your part.

j) Failure of the Approved Repairer to match the cosmetic finish of any other Alloy Wheel on the Vehicle.