Any minor damage which is not reported within 30 days of the incident date.

Any vehicle more than 7 years of age at the start of the policy.

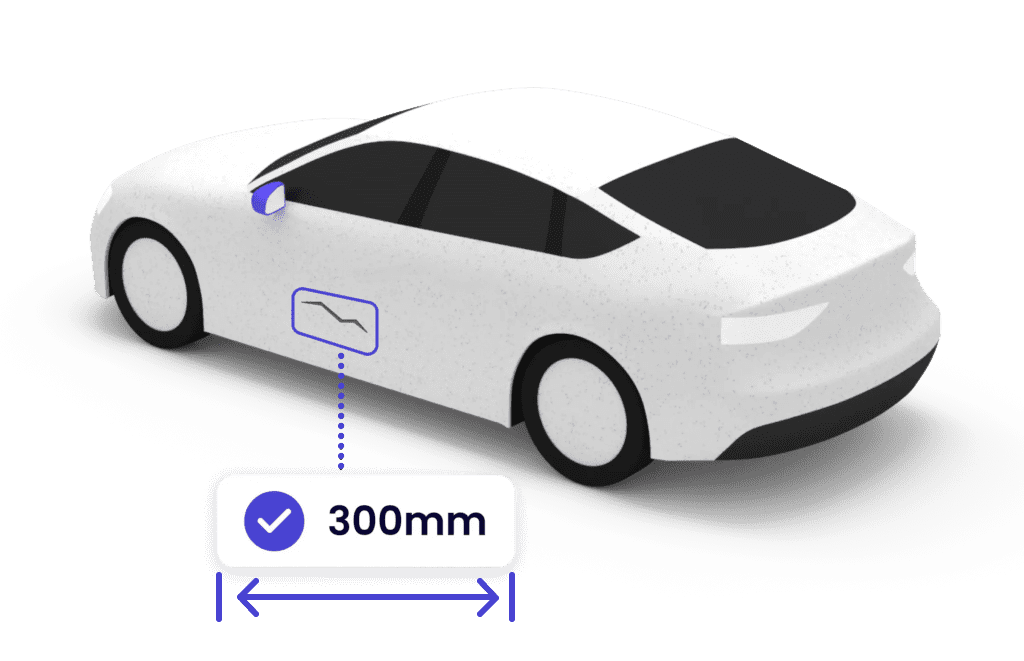

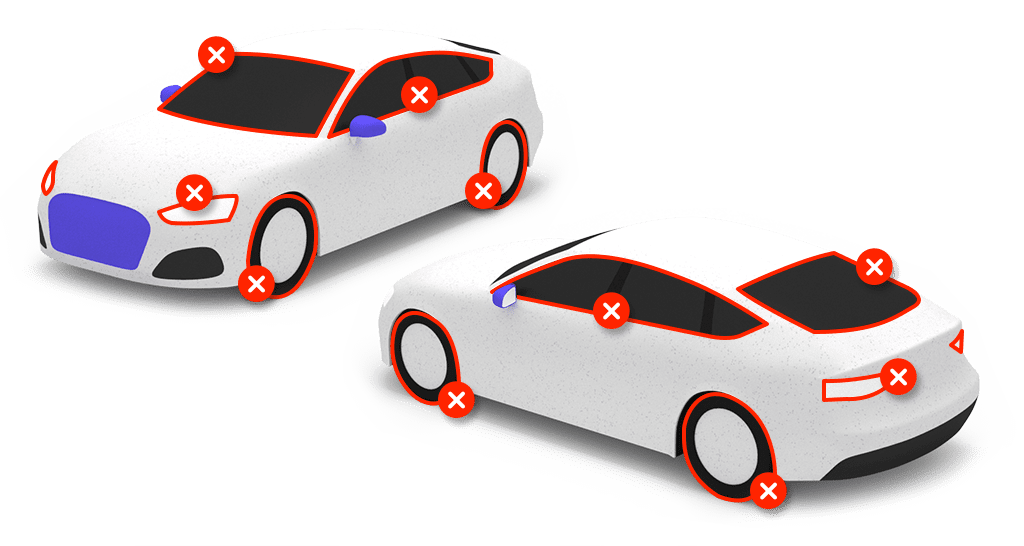

Damage that is not repairable by a SMART repair, is beyond minor cosmetic damage or because of the extent or number of areas of damage, a bodyshop repair is required.

Where the body panel, bumper or wing mirror is ripped, perforated, cracked or torn or there is damage to the structure and/or alignment

Damage to the locks or handles, beading, mouldings, lamps, window panels, tyres, wheels or wheel trims

Any amount in excess of the maximum limits shown in the policy schedule or terms and conditions

Any damage that is the subject of a motor insurance claim

Any claim relating to a road traffic accident or as a result of fire, theft or flood

Any damage that has been accumulated over an extended period, which is deemed to be wear and tear

Any damage showing evidence of rust or corrosion

Any damage the occurs within 14 days of the policy start date

The vehicle must not have a specialist bodywork finish, including self-healing, chrome illusion, matte or textured finish or bodywork wrap.